Is Credit Life Insurance Always A Udaap Violation : Metlife Direct Life Insurance: Life Insurance In Force Illustration / Male $30,000 in credit card debt).

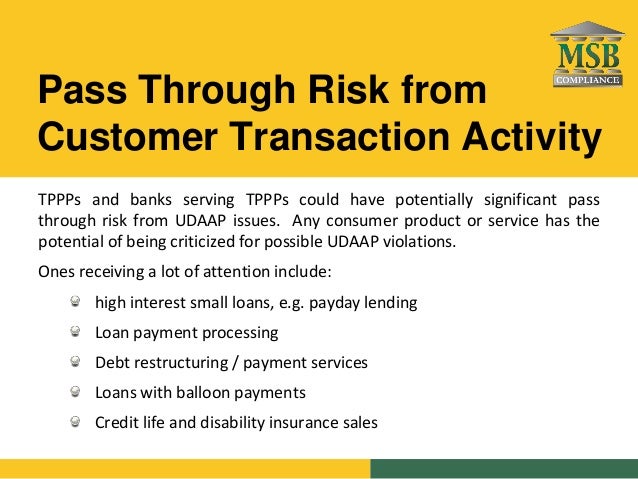

Is Credit Life Insurance Always A Udaap Violation : Metlife Direct Life Insurance: Life Insurance In Force Illustration / Male $30,000 in credit card debt).. Likewise, demographic targeting of products should be analyzed with potential udaap violations in mind. Credit life insurance pays your creditors upon your death. 00:12 intro (how to use a life insurance policy loan to wipe out credit card debt) 00:44 case study (30 y.o. There are some circumstances that you may not want to purchase a. Credit life insurance is a form of term life insurance.

A protection against the loss of income that would result if the insured. Find out how credit life insurance works and whether to buy this type of policy to prevent your debt from becoming a burden to heirs and business partners. In some cases, your only choice is to buy the whole package or none, even if you are ineligible for benefits under some of the policy types. That they won't run into credit certain life insurance companies will look at credit issues in a more scrutinizing manner than others. Ncua staff should use the general citation unfair, deceptive, or abusive acts or practices when citing udaap violations found in federal credit unions except for violations of regulations cfpb or the ncua issues under its respective udaap authority.

Is purchashing credit life and disability insurance for a vehicle loan a good idea in this scenario?

Credit risk is the risk to current or projected financial condition and resilience arising from an obligor's failure to meet the terms of any contract with the bank or otherwise perform as agreed. That they won't run into credit certain life insurance companies will look at credit issues in a more scrutinizing manner than others. Or (4) debt collection practices it considers to be in violation of udaap. The standard bank of south africa limited is a juristic. How does credit life insurance work? Credit life insurance policies are different from traditional life insurance coverage because of the way the death benefit is structured. Know here why buying life insurance is always a smart decision. 00:12 intro (how to use a life insurance policy loan to wipe out credit card debt) 00:44 case study (30 y.o. Before you jump into a life insurance settlement deal, you will have to come to terms with the fact that a third party will own. Find out how credit life insurance works and whether to buy this type of policy to prevent your debt from becoming a burden to heirs and business partners. Male $30,000 in credit card debt). A life insurance company profits by issuing coverage. A practical reason to purchase life insurance while you're young is because it is usually less expensive when you are young and healthy.

Life insurance isn't a fun topic to think about, but it can protect your loved ones in the event you were to pass away. How does credit life insurance work? Life insurance is not guaranteed by, or an obligation of any credit union and is not insured by ncua. Credit insurance is often sold in a package, which typically includes credit life insurance, disability insurance and unemployment or property coverage. Learn vocabulary, terms and more with flashcards udaap is a financial service industry acronym for unfair and deceptive or abusive acts and practices.

Insurance representatives are licensed to sell in north.

Is purchashing credit life and disability insurance for a vehicle loan a good idea in this scenario? Credit insurance is often sold in a package, which typically includes credit life insurance, disability insurance and unemployment or property coverage. A protection against the loss of income that would result if the insured. Let's say you sign on a personal loan, auto loan or a mortgage. Credit life insurance is insurance that's intended to pay off a borrower's debts at their death. Deposit insurance assessment credits from the fdic. The credit provider may also insist on paying the premiums on your behalf and, in turn, billing you for. Credit life insurance is a form of term life insurance. Credit life policies can be very expensive for what they cover and the time period they're in effect. What you may not know is that there are additional. The expiration of term life insurance is a little different from the conventional meaning of paying of personal loans and credit card debt. Medical underwriting uses the results of exams, blood tests, pharmacy no matter what your reason for considering guaranteed issue life insurance may be, it's always a good idea to get at least three quotes from various. Know here why buying life insurance is always a smart decision.

Life is unpredictable and life insurance provides peace of mind that you and your family are financially protected if the unthinkable happens. Male $30,000 in credit card debt). Note regarding citing violations of udaap: Credit life insurance is a form of term life insurance. What is credit life and joint credit life insurance coverage?

Most of the time, proceeds aren't taxable.

Credit life is insurance that will pay off the loan of your home should you die before mortgage is fully paid. There are some circumstances that you may not want to purchase a. Credit life insurance can be purchased when getting a loan for a vehicle (such as a car or life insurance tied to a loan can be a poor value. The standard bank of south africa limited is a juristic. Life insurance is not guaranteed by, or an obligation of any credit union and is not insured by ncua. Credit insurance is often sold in a package, which typically includes credit life insurance, disability insurance and unemployment or property coverage. Most life insurance policies require some type of medical underwriting. Likewise, demographic targeting of products should be analyzed with potential udaap violations in mind. Credit risk is the risk to current or projected financial condition and resilience arising from an obligor's failure to meet the terms of any contract with the bank or otherwise perform as agreed. Let's say you sign on a personal loan, auto loan or a mortgage. When you take out a loan, the lender may offer you a credit life insurance policy. This entitles it to receive part of the proceeds, up to the settlement value at the time of the insured event. Life insurance isn't a fun topic to think about, but it can protect your loved ones in the event you were to pass away.

Post a Comment